An insurance adjuster liaison streamlines claims settlement, acting as a bridge between insureds and insurers. They assess damage, coordinate with repair shops, ensure high-quality repairs meeting policy standards, and maintain transparent communication with all parties. Through efficient processes, effective communication, and meticulous attention to detail, adjusters expedite claim processing for car body repairs while fostering trust and transparency.

Unraveling the intricacies of the insurance adjuster liaison process is paramount for efficient claims management. This article serves as a comprehensive guide, offering insights into the defining roles of insurance adjusters and their crucial liaison functions. We explore key steps to streamline claims processing, emphasizing effective communication strategies essential for successful adjustments. By understanding these processes, professionals in the field can enhance client satisfaction and ensure fair resolutions, fostering trust in the industry.

- Defining Insurance Adjuster Liaison Role

- Key Steps in Processing Claims Efficiently

- Effective Communication Strategies for Adjusters

Defining Insurance Adjuster Liaison Role

The role of an insurance adjuster liaison is a critical component in the claims settlement process, serving as a bridge between insured individuals and insurance companies. This professional facilitates communication, ensuring that all parties understand their rights and responsibilities during the claim handling. They play a pivotal role in navigating complex scenarios, especially when it comes to assessing and negotiating repairs, such as those involved in vehicle dent repair or auto body repair.

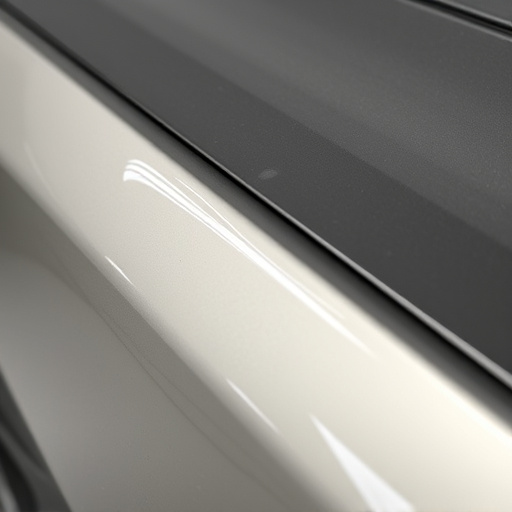

An insurance adjuster liaison is responsible for gathering necessary information, evaluating damage claims, and coordinating with auto body repair shops and paint specialists (like those specializing in auto painting) for accurate restoration. Their expertise lies in accurately determining the scope of work required, ensuring repairs are carried out to a high standard, and verifying that the final outcome meets insurance policy requirements. This meticulous process not only helps in expediting claims but also guarantees the quality and safety of restored vehicles, whether it’s fixing a minor dent or conducting extensive auto body repair.

Key Steps in Processing Claims Efficiently

Efficient claim processing is at the heart of any successful insurance adjuster liaison service. The key steps involve a well-defined and streamlined approach. First, adjusters swiftly assess the damage, whether it’s a minor vehicle dent repair or more complex car body restoration for luxury vehicles. This initial evaluation determines the level of expertise and resources required. Once assessed, the adjuster initiates communication with both the insured and the designated repair facility, ensuring everyone is aligned on the next steps.

The process continues with the adjuster gathering all necessary documentation, including reports, photos, and estimates. They verify the details with the policyholder while facilitating a seamless connection between the insurance company, the vehicle owner, and the chosen repair center. Regular updates ensure transparency throughout, leading to faster turnarounds for repairs like car body restoration, ultimately benefiting both parties in this collaborative effort.

Effective Communication Strategies for Adjusters

Effective communication is a cornerstone for insurance adjuster liaision processes. Adjusters act as the primary point of contact between insured parties and insurance companies, so they must possess strong verbal, written, and active listening skills. When dealing with policyholders who are often experiencing stress and uncertainty following an accident, clear and compassionate communication can significantly enhance the overall claims experience. For instance, using simple, non-technical language to explain complex processes like automotive body work or car dent removal can prevent confusion and build trust.

In the event of a car collision repair, insurance adjusters play a crucial role in guiding both parties through the claims process. They should be adept at gathering necessary information, documenting damage assessments, and providing transparent updates. Regular communication via phone calls, emails, or even text messages ensures policyholders remain informed every step of the way. Additionally, utilizing digital platforms for claims tracking can facilitate efficient interactions, ensuring that even minor details like car dent removal are accurately documented and addressed promptly.

Understanding the fundamentals of insurance adjuster liaison processes is crucial for efficient claims management. By clearly defining roles, streamlining communication, and adopting effective strategies, professionals in this field can enhance their service delivery. Mastering these basics ensures a seamless experience for policyholders, fostering trust and satisfaction in an often complex process. This knowledge equips insurance adjusters to navigate challenges, making them invaluable assets within the industry.