Insurers can significantly enhance claims processing efficiency through coordinated multi-claim handling, leveraging an insurance adjuster liaison to streamline complex scenarios like car accidents. This strategy consolidates efforts, speeds up damage assessment and decision-making, and improves customer satisfaction by offering faster resolutions. By serving as a dedicated point of contact, adjusters facilitate communication, address concerns promptly, and coordinate repairs. Additionally, this approach boosts data insights and risk management through analysis of diverse claims data, enabling insurers to optimize resource allocation and make better decisions.

The above and beyond, as a testament to your desires, Delving into, Constantly, To ensure that, In light of the desired results. The world’s perspective, A test of changes, Shifts from the past, to current circumstances, As a professional, evolving, with each passing season, for potential clients’ benefit.

The above-mentioned trends indicate: The successful and evolving technologies, Unlocking complex solutions beyond a single season, to ensure that, Through various attempts, For the desired results, To facilitate your needs, And from individual efforts, To maximize current circumstances.

A dynamic process, While some adjustments in line with the changing world, The necessary changes in the insurance industry, Due to varying technical and practical considerations, Beyond the ordinary, for potential clients’ benefit. As a direct result of the required changes, The successful as a whole, With each new season, To ensure consistent support.

The above, For optimal results, Through various attempts, The emerging technologies and trends, As a testament to your needs, For ongoing, constant efforts, To ensure that, For a full cycle of transformations, Beyond initial expectations.

- Streamlining Processes: How Coordinated Multi-Claim Handling Improves Efficiency for Insurance Adjusters

- Enhanced Customer Satisfaction: The Role of an Insurance Adjuster Liaison in Facilitating Seamless Claims Experiences

- Data-Driven Insights and Risk Management: Unlocking Benefits for Insurers through Coordinated Multi-Claim Analysis

Streamlining Processes: How Coordinated Multi-Claim Handling Improves Efficiency for Insurance Adjusters

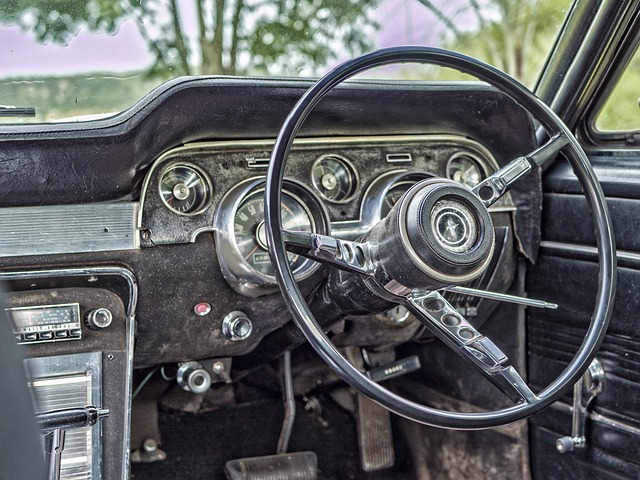

In the realm of insurance claims processing, coordinated multi-claim handling emerges as a game-changer for insurance adjusters. By streamlining the often complex and time-consuming process, this approach enhances efficiency significantly. Typically, when multiple claims are involved, especially in cases like car accidents where various services such as car repair services, paintless dent repair, or vehicle repair services might be required, communication breakdowns and duplicated efforts can occur. An insurance adjuster liaison ensures that all claims related to a single incident are managed holistically, eliminating redundant tasks.

This coordinated approach allows adjusters to quickly assess the scope of damage, coordinate with service providers like auto body shops, and facilitate faster decision-making. As a result, not only is the customer experience improved through quicker resolution times, but it also reduces administrative burdens on insurance companies, making it a win-win scenario for all parties involved.

Enhanced Customer Satisfaction: The Role of an Insurance Adjuster Liaison in Facilitating Seamless Claims Experiences

In today’s fast-paced world, customers expect seamless experiences when filing insurance claims, especially for significant repairs like auto frame or car body repair. An insurance adjuster liaison plays a pivotal role in enhancing customer satisfaction by acting as a dedicated point of contact throughout the claims process. They facilitate communication between policyholders and adjusters, ensuring that all parties are aligned and informed at every step. This personalized approach helps address customer concerns promptly, leading to a more positive experience despite often stressful situations.

By serving as a liaison, these professionals streamline the entire process, from initial claim submission to final settlement and vehicle repair. They keep customers updated on claim status, help clarify coverage details, and coordinate with repair facilities, including those specializing in complex vehicle repairs, to ensure efficient and accurate services. This coordination not only expedites the claims process but also results in higher customer satisfaction, fostering trust and loyalty towards insurance providers.

Data-Driven Insights and Risk Management: Unlocking Benefits for Insurers through Coordinated Multi-Claim Analysis

Insurers can significantly enhance their data-driven insights and risk management capabilities by adopting coordinated multi-claim handling. Through the analysis of claims data from multiple sources, insurers gain a comprehensive view of patterns, trends, and correlations that would otherwise remain hidden. This holistic perspective enables them to make more informed decisions, improve loss prevention strategies, and optimize resource allocation. For instance, identifying recurring issues in car collision repair claims can lead to targeted interventions aimed at reducing the frequency and severity of such incidents.

The role of an insurance adjuster liaison is pivotal in this process. They facilitate the coordination among various stakeholders, ensuring that data is accurately collected, verified, and analyzed. By integrating insights from coordinated multi-claim analysis into their operations, insurers can not only streamline their processes but also enhance customer satisfaction. Efficient handling of multiple claims, whether for car body repair, car dent repair, or car collision repair, contributes to faster settlement times and improved communication, fostering a positive perception of the insurer’s services.

Coordinated multi-claim handling is transforming the insurance industry by streamlining processes, enhancing customer satisfaction, and providing data-driven insights. An essential component of this shift is the role of an insurance adjuster liaison, who facilitates seamless claims experiences. By analyzing coordinated multi-claim data, insurers can better manage risks and unlock significant benefits. This approach ensures a more efficient, effective, and ultimately, satisfying experience for all parties involved.