Insurance adjuster liaisons act as neutral mediators in claims disputes between policyholders and insurers, specializing in vehicle damage assessments and negotiations for auto repairs. They possess strong communication and analytical skills, interpreting policies and laws to ensure fair compensation while managing stakeholders' expectations. Their balanced approach, coupled with industry knowledge, facilitates swift resolutions, protecting clients' interests in complex repair scenarios.

In the intricate world of insurance, the role of an insurance adjuster liaison is pivotal. They bridge the gap between policyholders and insurers, facilitating claims processes. But who takes the lead when disputes arise? This article delves into the specific responsibilities of these professionals in resolving conflicts.

We’ll explore how their expertise navigates complex situations, ensuring fair outcomes. From understanding the role to implementing effective dispute resolution strategies, we uncover the essential skills required for successful insurance adjuster liaison.

- Understanding the Insurance Adjuster Liaison Role

- Who is Responsible for Dispute Resolution?

- Effective Strategies for Handling Disputes in Liability Cases

Understanding the Insurance Adjuster Liaison Role

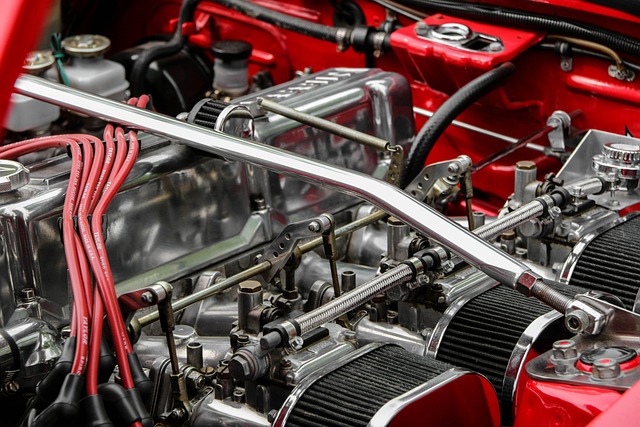

In the dynamic landscape of insurance claims management, the insurance adjuster liaison plays a pivotal role in facilitating smooth resolution between policyholders and insurance companies. This professional acts as a bridge, coordinating efforts to ensure that claims are processed efficiently and fairly. Their primary responsibility involves assessing and documenting damage to vehicles, which is crucial for determining compensation during auto maintenance or collision repair processes.

By conducting thorough inspections at collision repair centers, these liaisons verify the extent of vehicle repairs needed, ensuring that policyholders receive accurate estimates and timely payouts. They communicate effectively with all parties involved, including insurance carriers, repair shops, and policyholders, to navigate complex claims scenarios. This role demands excellent communication skills, a keen eye for detail, and the ability to remain impartial throughout the dispute resolution process.

Who is Responsible for Dispute Resolution?

In the realm of insurance claims management, dispute resolution is a critical aspect often handled by skilled professionals known as insurance adjuster liaisons. These experts play a pivotal role in resolving disagreements between insured individuals and insurance companies, ensuring a fair process for all parties involved. When a claim is contested or requires additional clarification, the responsibility falls upon these liaisons to navigate the complexities of the situation.

Insurance adjuster liaisons serve as the primary point of contact for clients seeking resolution. They possess a deep understanding of both insurance policies and legal frameworks, enabling them to interpret policy terms and apply relevant laws. Whether it’s regarding body shop services, auto collision center repairs, or intricate auto frame repair processes, these liaisons carefully examine the facts, gather evidence, and facilitate negotiations. Their goal is to reach mutually agreeable outcomes while upholding the interests of their clients.

Effective Strategies for Handling Disputes in Liability Cases

Effective strategies for handling disputes in liability cases, a key responsibility of insurance adjuster liaisons, involve a blend of empathy, assertiveness, and meticulous documentation. When dealing with claims related to vehicle bodywork damage, or auto body work repairs, as these are common areas of contention, adjusting liaisons must remain impartial mediators. They should actively listen to both parties’ accounts, encouraging open communication while ensuring all relevant details are captured accurately in the record.

To manage such disputes successfully, insurance adjuster liaisons can employ several tactics. Firstly, they should gather comprehensive information about the incident, including witness statements and photographic evidence of the vehicle’s damage. This enables a thorough analysis that supports the decision-making process. Secondly, maintaining a calm and professional demeanor throughout negotiations fosters an environment conducive to rational discussions. Lastly, staying updated on industry standards for auto detailing and bodywork repairs ensures decisions are fair, accurate, and aligned with current best practices.

Insurance adjuster liaisons play a pivotal role in resolving disputes, ensuring smooth claims processes, and fostering client satisfaction. As the primary point of contact between policyholders and insurance companies, they must possess exceptional communication skills and a deep understanding of dispute resolution strategies. By implementing effective techniques outlined in this article, such as active listening, clear documentation, and collaborative problem-solving, insurance adjusters can efficiently navigate complex liability cases, ultimately reaching favorable outcomes for all parties involved.