Insurance adjuster liaisons streamline vehicle collision repair claims, including bumper repairs, by fostering clear communication between policyholders, garages, and insurers. They accelerate settlement processes, ensure fair compensation, build trust, and enhance policyholder satisfaction through regular updates and understanding of claim procedures. Adjusters also facilitate structured damage reporting and direct communication to avoid misunderstandings, enabling efficient claims resolution with transparent frame straightening assessments.

In the complex landscape of claims processing, miscommunication can lead to costly mistakes and dissatisfied policyholders. Understanding the advantages of clear, accurate communication is essential for every stakeholder involved, particularly the insurance adjuster liaison. This article explores strategies to prevent claim miscommunication, focusing on its impact on policyholder satisfaction. We delve into effective approaches to enhance clarity in complex claims, emphasizing the pivotal role of insurance adjuster liaison in ensuring positive outcomes for all parties.

- Preventing Claim Miscommunication: A Key Role for Insurance Adjuster Liaison

- The Impact of Accurate Communication on Policyholder Satisfaction

- Strategies to Enhance Clarity in Complex Claims Processing

Preventing Claim Miscommunication: A Key Role for Insurance Adjuster Liaison

Insurance adjuster liaison plays a pivotal role in preventing claim miscommunication, which is often a significant hurdle in the claims process. When an individual files an insurance claim for vehicle collision repair, such as bumper repair or other damages, clear and effective communication between all parties involved is essential. An insurance adjuster acts as a liaison, ensuring that policyholders, garages, and insurers have accurate, up-to-date information throughout the entire process.

By serving as a bridge between these entities, insurance adjusters help avoid misunderstandings regarding coverage, costs, and repairs needed. This proactive approach not only expedites the claims settlement but also guarantees that policyholders receive fair compensation for their vehicle repair, including bumper repair or any other necessary vehicle collision repair services. Effective liaison ensures everyone is on the same page, leading to a smoother process for all involved.

The Impact of Accurate Communication on Policyholder Satisfaction

Effective communication between insurance adjusters and policyholders is a cornerstone of building trust and satisfaction. When an insurance adjuster acts as a liaison, providing clear and transparent updates, explaining coverage details, and addressing concerns promptly, it significantly enhances the policyholder’s experience. This two-way dialogue ensures that the policyholder understands their rights, responsibilities, and the process of claim settlement. As a result, policyholders feel valued and informed, leading to higher levels of satisfaction with the insurance company.

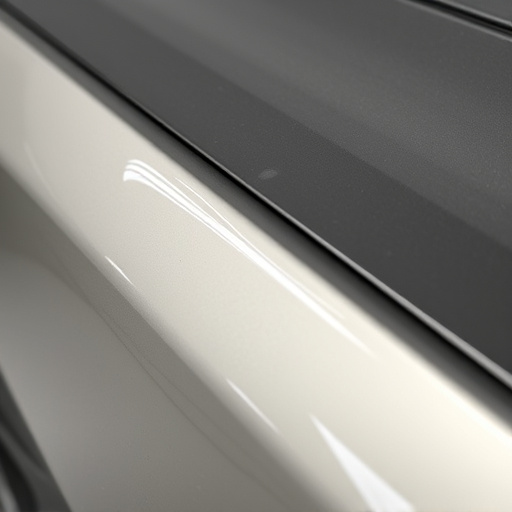

In scenarios involving car body shop repairs or frame straightening after an auto collision, accurate communication becomes even more critical. Policyholders who receive regular updates on their claim status, expected repair timelines, and potential costs are better equipped to make informed decisions. This transparency fosters a positive perception of the insurance company and can lead to stronger relationships, encouraging policyholders to choose the same insurer for future coverage needs.

Strategies to Enhance Clarity in Complex Claims Processing

In the intricate world of claims processing, where nuances and details matter, enhancing clarity is a powerful strategy to avoid misunderstandings. Insurance adjusters play a pivotal role in this regard, acting as liaison between policyholders and repair facilities. One effective approach is to implement structured communication protocols, ensuring every step of the process is transparent and well-documented. This includes clear guidelines for reporting damages, whether it’s a simple fender bender or complex property damage. For instance, encouraging policyholders to provide detailed descriptions, including photos, can significantly streamline the evaluation process.

Moreover, establishing direct lines of communication between adjusters, repair shops (like collision repair shops), and tire services can prevent misinterpretations. Regular check-ins and progress updates ensure everyone is on the same page, facilitating faster decision-making. Frame straightening techniques, when applied to claims, involve meticulous attention to detail, ensuring every angle is considered, leading to more accurate assessments. This, in turn, reduces the likelihood of claim miscommunication, fostering a more efficient and effective resolution process.

By prioritizing clear and effective communication, especially through the strategic involvement of an insurance adjuster liaison, miscommunication can be significantly reduced. This not only enhances policyholder satisfaction but also streamlines the claims process, making it more efficient and less stressful for all involved parties. An insurance adjuster liaison plays a pivotal role in ensuring that claims are handled with precision and transparency, fostering trust and building stronger relationships between insurers and policyholders.